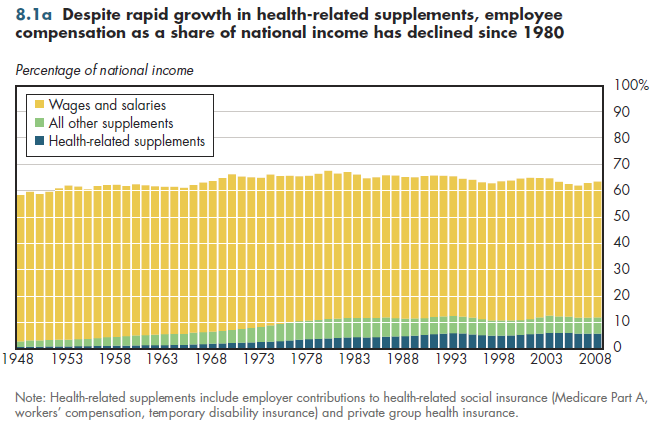

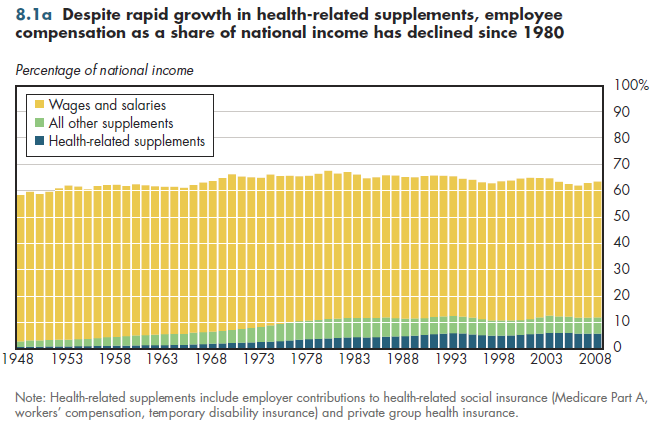

Health-related fringe benefits have grown far more rapidly than has national income over the past 60 years. Yet the share of national income accounted for by employee compensation — wages, salaries, and supplements — has declined somewhat since its 1980 peak (figure 8.1a). This again shows that in the end, fringe benefits come out of worker pay, not corporate profits.

National income can be viewed as an alternative way of measuring the net value of annual output, by adding all the costs of producing it. GDP measures gross output, but to arrive at a net national product (NNP), capital consumption (for example, depreciation of machinery) is not included. In the Bureau of Economic Analysis (BEA) National Income and Product Accounts (NIPA), national income measures the earnings of all factors of production used to produce NNP. These factors include wages, salaries, supplements, rents, interest, and profits and losses. In principle, this should equal the same sum measured in terms of final products (consumption + investment + government purchases + imports). However, because NNP and national income are measured using completely different methods, a small statistical adjustment is needed to reconcile the two totals.

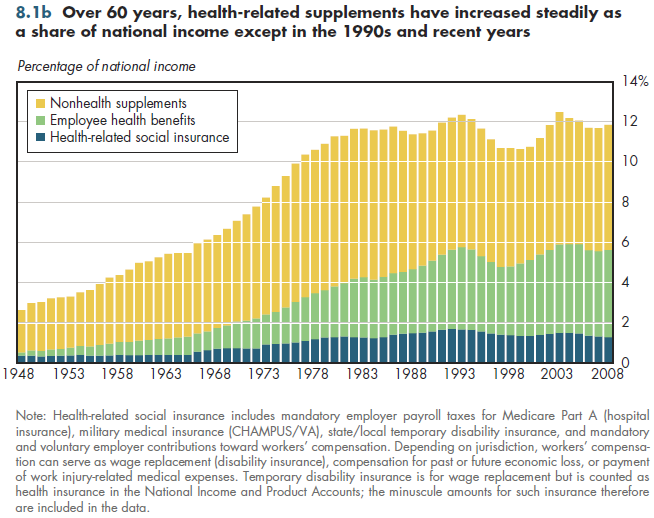

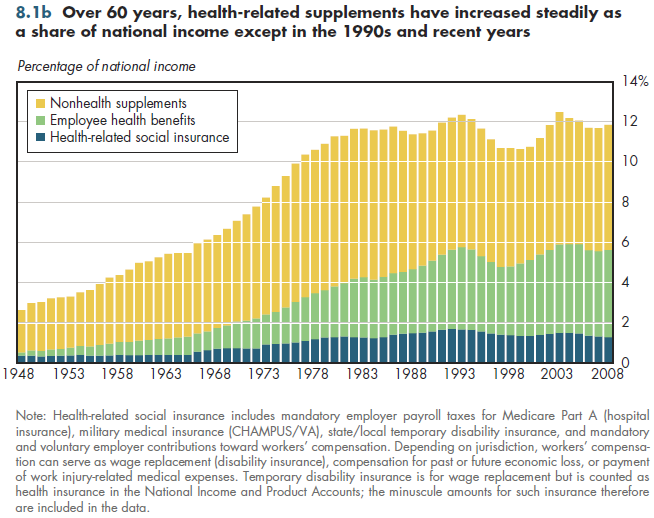

Health-related supplements include not only employer-provided health coverage, but also legally required payroll deductions made by employers for Medicare and workers' compensation. Other fringe benefits, such as pensions or employer-paid retirement contributions, also grew much more rapidly than wages and salaries during this period, although not as rapidly as health-related supplements.

Examined in more detail, mandatory health-related payroll deductions for workers' compensation and Medicare peaked at 1.7 percent of national income in the early 1990s and have declined subsequently (figure 8.1b). Employee health benefits reached 4.1 percent of national income by 1993, declined during the boom years of the 1990s, peaked again at 4.4 percent in 2003 to 2005, slightly declining again thereafter. Non-health supplements peaked at 7.4 percent in the early 1980s and steadily declined thereafter until 2002, when they began increasing again. If health reform is implemented, the combination of employer penalties and mandatory increases in generosity of coverage make it possible that the employee health-benefits share will increase in future years.

Download Excel tables used to create

Figures 8.1a/8.1b Tables.

Figures 8.1a and 8.1b were created from the following tables (the workbook includes all supporting tables used to create this table):

- Fig. 8.1a: Table 8.1.1. Total Employee Compensation -- Wages, Salaries, and Fringes -- As a Percentage of National Income, 1948-2008

- Fig. 8.1b: Table 8.1.2. Health-related Fringe Benefits as a Percentage of National Income by Type, 1948-2009

Download PowerPoint versions of both figures.

- Department of Commerce. Bureau of Economic Analysis.