Download PowerPoint versions of both figures.

Inside Collection (Book): American Health Economy Illustrated

20.7 Projected 75-Yr Increase in Mandatory Federal Health Spending Exceeds the Largest Source of Tax Revenue

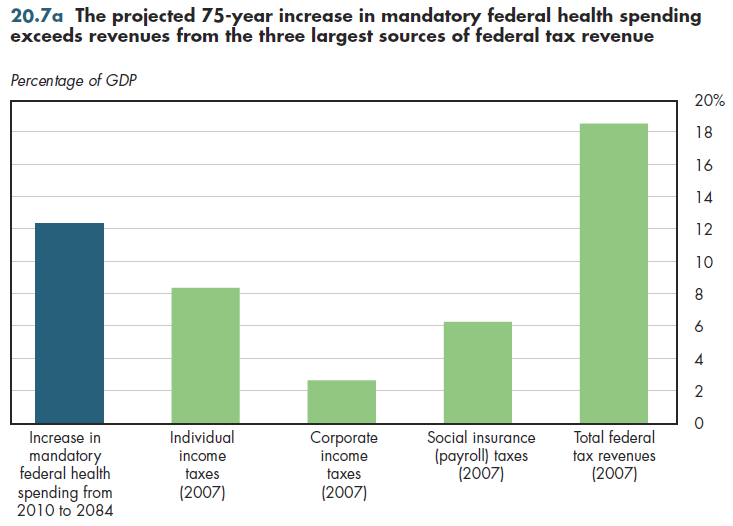

Summary: The projected 75-year increase in mandatory federal health spending exceeds current revenues from the three largest sources of federal tax revenue.

The size of the projected increase in mandatory federal health spending dwarfs the amount currently collected through the three largest sources of federal revenue (figure 20.7a). Thus, filling the fiscal gap through higher taxes would imply more than doubling individual income taxes, quintupling the amount collected in corporate income taxes, or tripling current payroll taxes (all approximations). Alternatively, because the long-run increase in mandatory federal health spending amounts to 67 percent of federal tax revenue, this would imply that a minimum 67 percent increase in federal taxes across the board would be needed to tax ourselves out of the health entitlements burden. Of course, given the inevitable behavioral response that would result from increasing taxes by this magnitude, the increase in tax rates would have to be even higher than these multipliers suggest.

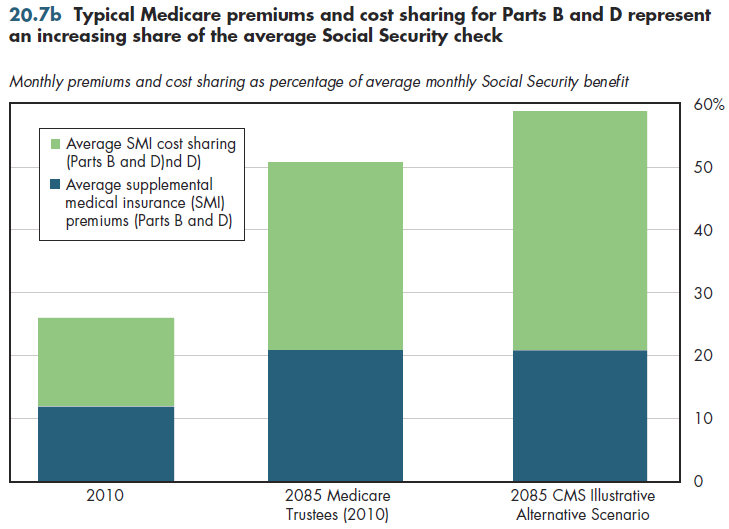

Even if taxpayers could find a way to bankroll the enormous increases in health spending reviewed in this section, it is less clear that beneficiaries of public insurance programs such as Medicare can absorb their share of rising health costs. By 2085, the out-of-pocket burden of just Medicare Parts B and D will approximately double for the average Social Security recipient (figure 20.7b). By 2085, premiums and out-of-pocket expenses will absorb more than half of the average Social Security check, assuming that such checks are not trimmed as part of the efforts to save Social Security. This does not even count any cost sharing associated with Medicare Part A. The CMS Office of the Actuary has developed an illustrative alternative scenario that recognizes that some of the Medicare spending reductions contemplated by the health reform law might not occur. For example, the cuts in physician fees required by the sustainable growth rate formula (SGR) now have been overridden by Congress for nine consecutive years. Under this alternative scenario, premiums and out-of-pocket expenses for Medicare Parts B and D would equal four-fifths of the average Social Security check by 2085.

Burdens of this magnitude will amplify pressures for the federal government to subsidize such individuals even more to make their health care affordable. This would then further escalate the amount of federal health spending beyond the levels already described. Finding ways to reduce spending, rather than raising revenues, at least offers the prospect of averting this bind on the elderly who have fixed incomes.

Downloads

References

- Author's calculations.

- Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, The. 2010 Annual Report. US Government Printing Office. August 5, 2010.

- Congressional Budget Office.

- Organisation for Economic Co-operation and Development.

- Potetz L and J Cubanski. A Primer on Medicare Financing. July 2009. http://www.kff.org/medicare/upload/7731-02.pdf (accessed August 10, 2010).

Collection Navigation

- « Previous module in collection 20.6 Long-Term Unfunded Liabilities Associated with Health Entitlements Exceed $66 Trillion

- Collection home: American Health Economy Illustrated

- Next module in collection » 20.8 US Will Face Challenge of an Increasing Number of Dependents per Working Adult

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 24, 2013 3:09 pm -0500