Download PowerPoint versions of both figures.

Inside Collection (Textbook): American Health Economy Illustrated

14.2 Concentration in Health Insurance Industry

Summary: Seemingly high levels of concentration in the health insurance industry might not accurately depict its competitiveness. Concentration is increasing for both hospitals and health insurers.

By conventional measures, the health insurance industry is highly concentrated. Some experts worry that lack of competition might result in higher premiums for health coverage than would otherwise prevail in a more competitive market. Economists measure concentration using what is called a Herfindahl-Hirschman Index (HHI). The calculation involves squaring the market shares of each competitor in a market and adding the results. For a monopolist having a market share of 100 percent, the HHI would be 10,000 (1002 = 10,000). Ten competitors each with equal market shares would produce an HHI of 1,000 (10 × 102). For purposes of antitrust regulation, the Federal Trade Commission (FTC) currently views areas with an HHI of 2,500 and more as highly concentrated. Transactions that increase the HHI by more than 100 points in highly concentrated markets presumptively raise antitrust concerns.

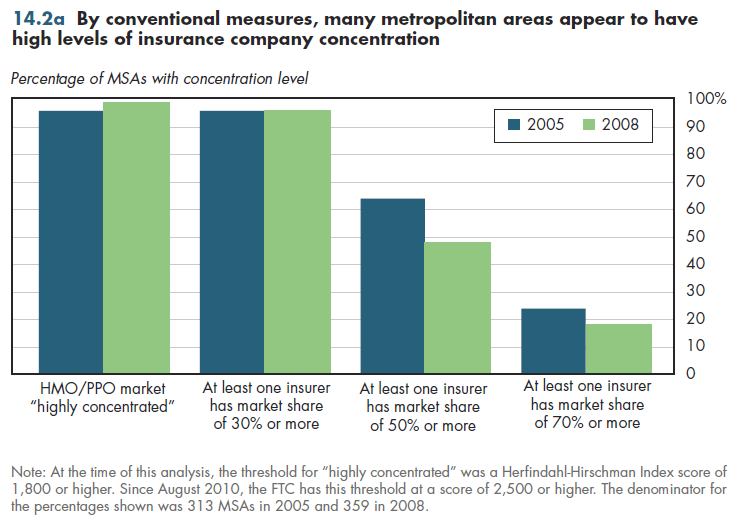

Using an HHI threshold of 1,800 that the FTC used prior to August 2010, in more than 90 percent of metropolitan statistical areas (MSAs), the market for insurers offering fully insured HMO or PPO plans is highly concentrated. A related measure shows that in more than 90 percent of MSAs, a single insurer for these products accounts for 30 percent of the market (figure 14.2a). In more than 60 percent of markets, the dominant insurer has more than half of all market shares, and in 25 percent of MSAs, this share exceeds 70 percent.

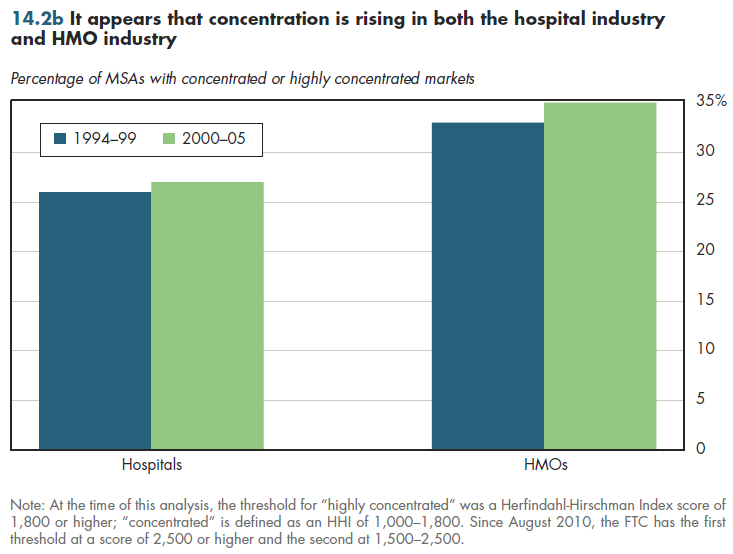

However, other studies have found much less concentration (figure 14.2b). Moreover, all the foregoing calculations focus on the fully insured market, ignoring self-funded health plans. Most large employers self-fund their health benefits: They absorb the risk and hire a health insurer or third-party administrator to pay claims. Approximately 60 percent of employer coverage is through such plans. Having market power does not mean it can be exercised. The modest profitability levels for health insurers described previously are not consistent with insurers having a widespread ability to demand supra-competitive prices. Although these measures do not paint a completely accurate picture of competitiveness in the health insurance industry, they do suggest that concentration might be increasing.

Downloads

References

- American Medical Association. Competition in Health Insurance, 2010 Update. Chicago. 2010. Managed Market Survey © 2008, HealthLeaders-InterStudy.

- Shen YC, VY Wu and G Melnick. Trends in Hospital Cost and Revenue, 1994-2005: How Are They Related to HMO Penetration, Concentration, and For- Profit Ownership? Health Services Research 2010; 45(1):42-61.

Collection Navigation

- « Previous module in collection 14.1 Less than Half of US Health Workers Are Employed by Large Firms

- Collection home: American Health Economy Illustrated

- Next module in collection » 14.3 US Health Sector Is Highly Regulated

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 25, 2013 2:25 pm -0500