Download PowerPoint versions of both figures.

Inside Collection (Textbook): American Health Economy Illustrated

15.1 Health Spending per Capita Has Grown Twice as Fast as per Capita Net Worth

Summary: Since the early 1950s, real health spending per capita has grown approximately twice as fast as real per capita net worth.

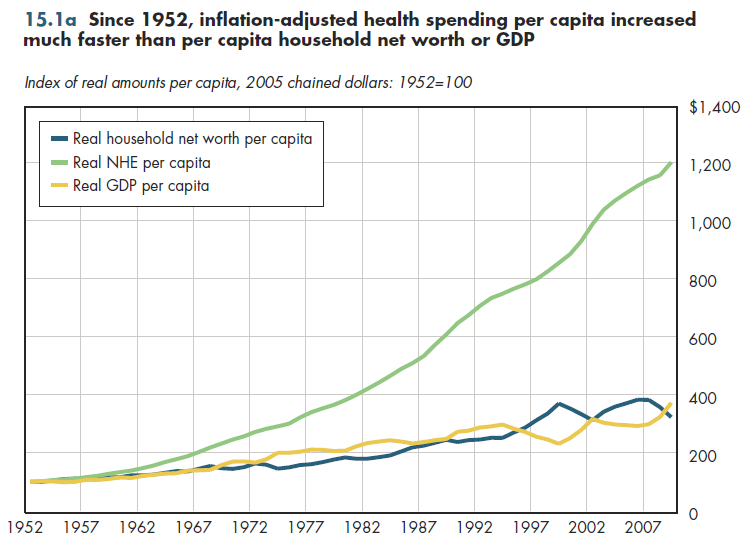

Since 1952, inflation-adjusted health spending per capita rose much faster than per capita net worth or GDP (figure 15.1a). Net worth is the excess of assets over liabilities. According to Federal Reserve data, the net worth of U.S. households at the end of 2008 was $56 trillion. The nation's net worth includes the net worth held by house- holds and non-profit organizations. This represents the total wealth of the nation because assets held at the household level reflect any net worth held by corporations and non-corporate businesses.

Over 55 years starting in 1952—that is, excluding the most recent economic downturn—net worth increased at an annual rate of 7.3 percent, as compared with an increase of 6.8 percent in GDP. Adjusting for general inflation and population growth, these numbers decline to 2.5 percent and 2.0 percent, respectively. These numbers imply that on a per-person basis, real wealth doubles every 29 years and real GDP doubles every 35 years.

Real per capita health spending grew 4.5 percent over the same period. This was 80 percent faster than the pace at which net wealth increased. This pace implies a doubling of real per-person spending (in general purchasing power terms, not medical dollars) every 16 years.

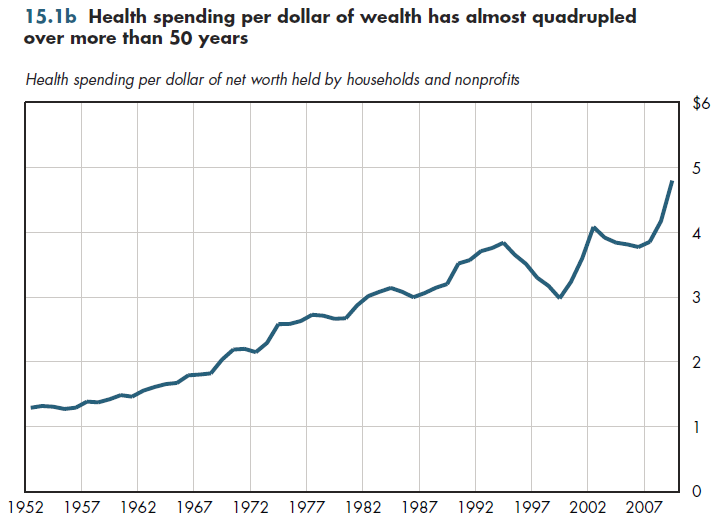

A clearer way to see this difference is to calculate health spending for every $100 of net worth. When Mr. Eisenhower was elected president in 1952, this ratio was $1.29 in spending per $100 of wealth. By 2007, this amount had increased to $3.86 (figure 15.1b). Because of the steep decline in net worth from 2007 to 2009, coupled with ever-rising health costs, this ratio had reached $4.80 by the end of 2009. Health spending does not put us in danger of eradicating national wealth, but it is steadily chipping away at it, decade after decade. Health spending has not yet resulted in a reversal of real gains in national income (GDP) (refer to figure 20.4a). Likewise, increasing medical costs have not prevented real national wealth from increasing. However, less rapid increases in health spending in principle might have allowed for more rapid gains in wealth.

Downloads

References

- Author's calculations.

- Department of Commerce. Bureau of Economic Analysis.

- Department of Health and Human Services. Centers for Medicare and Medicaid Services.

- Federal Reserve Bank.

Collection Navigation

- « Previous module in collection 14.4 Unionization Rates in the Health Industry

- Collection home: American Health Economy Illustrated

- Next module in collection » 15.2 Low-Income US Family May Incur Health Spending that Exceeds Their Net Worth

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 25, 2013 2:19 pm -0500