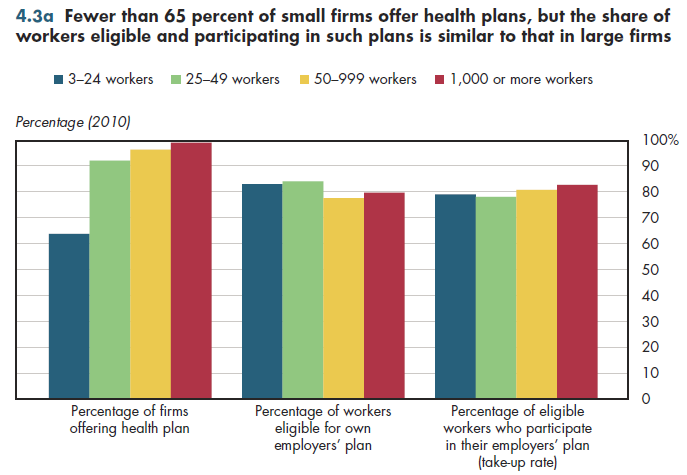

Fewer than half of firms that have 25 or fewer employees even offer health insurance coverage. In contrast, virtually all firms that have 1,000 or more workers offer such benefits (figure 4.3a). Thus, if a worker gets employer-sponsored health benefits depends heavily on the number of workers at a given firm.

In general, employer-provided health benefits are not as attractive to small-firm workers compared with those who work in large firms. Premiums generally are higher for the same amount of coverage because the administrative load is higher. Some costs, such as general administration, do not vary much by firm size, resulting in economies of scale in health insurance for firms that have more workers to share the administrative cost. With fewer workers among whom such costs can be spread, the per-person cost is higher in small firms. To reflect greater volatility in expected claims for small firms relative to large firms, insurers also must include a higher risk premium.

In a voluntary market, insurers know from experience that the small firms have sicker employees than do large firms. That is, small firms will know the individual health needs of their employees much better than large firms do. Moreover, they have far fewer plan members among whom to spread the cost of someone who has a high-cost medical condition. In a market where premiums are higher for the smallest firms, the companies that have the greatest individual employee health needs will be the most motivated to search for coverage. This amplifies the tendency for insurers to charge small firms higher premiums to reflect the generally poorer health among workers in small firms seeking coverage.

However, when an employer has made the decision to offer health coverage, firm-size differences are attenuated considerably. In fact, the percentage of workers eligible for the health plan actually is slightly higher among small firms relative to larger firms, although the percentage of workers who accept whatever health coverage offered is only slightly less.

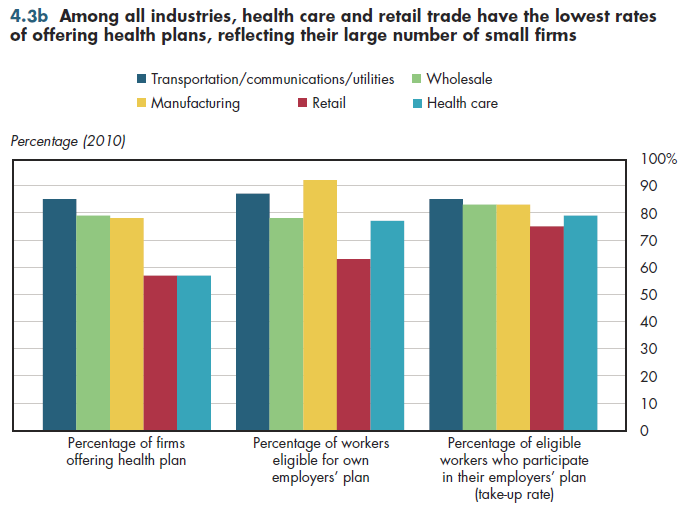

The variation in the percentage of firms offering health insurance by industry is somewhat smaller than by firm size, with health care and retail trade having the low- est offer rates, while transportation, communications, utilities, wholesale trade, and manufacturing have the highest (figure 4.3b). The higher concentration of small firms in health care and retail trade contributes to these differences.

Download Excel tables used to create

Figures 4.3a/4.3b Tables.

Figures 4.3a and 4.3b were created from the following table (the workbook includes all supporting tables used to create this table):

- Fig. 4.3a: Table 4.3.1. Health Insurance Benefits Offer Rates, Worker Eligibility Rates, and Take-up Rates, by Size of Firm, 2010 and 2013

- Fig. 4.3b: Table 4.3.2. Health Insurance Benefits Offer Rates, Worker Eligibility Rates, and Take-up Rates, by Industry, 2010 and 2013

Download PowerPoint versions of both figures.

- Kaiser Family Foundation, The. Health Research & Educational Trust. Employer Health Benefits 2010 Annual Survey. September 2, 2010. http://ehbs.kff.org/?page=abstract&id=1 (accessed November 21, 2010).