Download PowerPoint versions of figure.

Inside Collection (Book): American Health Economy Illustrated

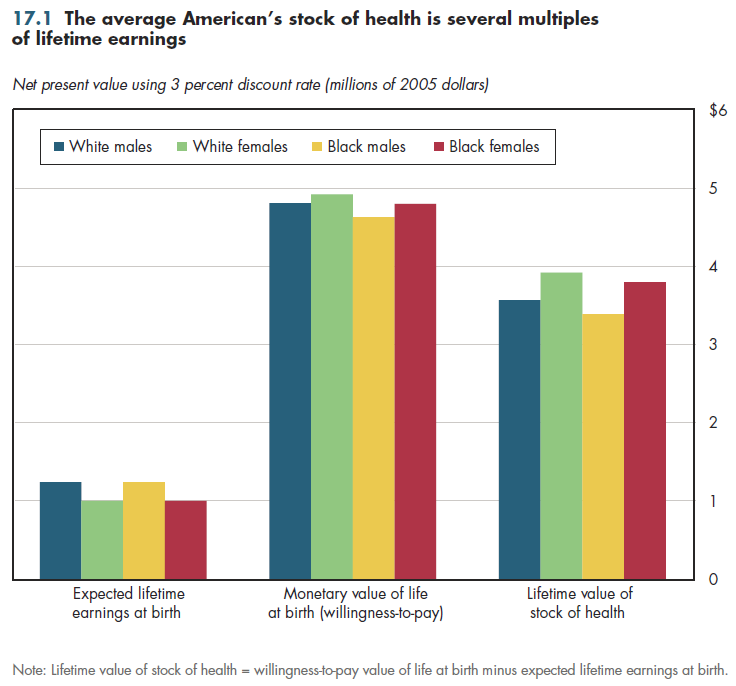

17.1 Average American's Stock of Health Is Several Multiples of Lifetime Earnings

Summary: The value of a typical American's stock of health at birth is several multiples of his or her lifetime earnings.

The health capital (value of their health) for average individuals in the United States is several times as large as expected lifetime earnings. This calculation converts future earnings to a present value, using a real discount rate of 3 percent. This is approximately equivalent to the inflation-adjusted rate of return paid on long-term U.S. Treasury bills. Most economists believe that this approximates the social discount rate, that is, the degree to which the value of a future dollar declines compared with today's dollar. A 3 percent rate implies that a dollar one year from now is worth only 97 cents in today's dollars. Another way to think about it is that 3 percent represents the amount people would have to be paid today to get back a dollar in one year.

There obviously is a great deal of variation across different individuals in lifetime earnings. Calculating from available evidence about earnings by age in 2005 dollars discounted back to the present, the average U.S. citizen will earn approximately $1 million or more over a lifetime. Figure 17.1 illustrates how this average varies by gender and race. Lifetime earnings represent a conservative estimate of the value of a human life. Economists have used various methods to calculate the willingness-to-pay value of a human life. For example, consider workers in risky jobs who are willing to be paid $10,000 more a year in exchange for a 1 percent increase in their risk of dying on the job in any given year. This implies that collectively, such workers are willing to be paid $1 million in exchange for one of them dying. Their willingness-to-pay value for life is said to be one million dollars. Based on this kind of real-world evidence about willingness to accept higher pay in exchange for loss of a statistical life, the present value of a life at birth averages almost five million dollars (there is wide variation in this number across studies). Due to differences in life expectancy, this value varies by race and gender.

Willingness-to-pay encompasses both the expected amount of future earnings (because these future earnings have value to the earner), as well as the intangible value of life. Thus, subtracting expected earnings from the willingness-to-pay value of a life, the result is the intangible value of each U.S. worker's stock of health when born. This is invariably much larger than lifetime earnings.

Downloads

References

- Author's calculations.

- Department of Commerce. Bureau of the Census.

- Murphy KM and RH Topel. The Value of Health and Longevity. Journal of Political Economy 2006; 114(5):871-904.

Collection Navigation

- « Previous module in collection 16.3 Unemployment Rates for Male Workers in the Health Sector Are Lower than the Rest of the Economy

- Collection home: American Health Economy Illustrated

- Next module in collection » 17.2 How Price of Treatments Changes over Time Depends on How Innovations Are Measured

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 24, 2013 4:13 pm -0500