Download PowerPoint versions of both figures.

Inside Collection (Book): American Health Economy Illustrated

4.4 A Secular Decline In Employer-Based Health Coverage

Summary: Despite relatively stable health insurance offer rates, there has been a secular decline in employer-based health coverage across nearly all firm-size categories.

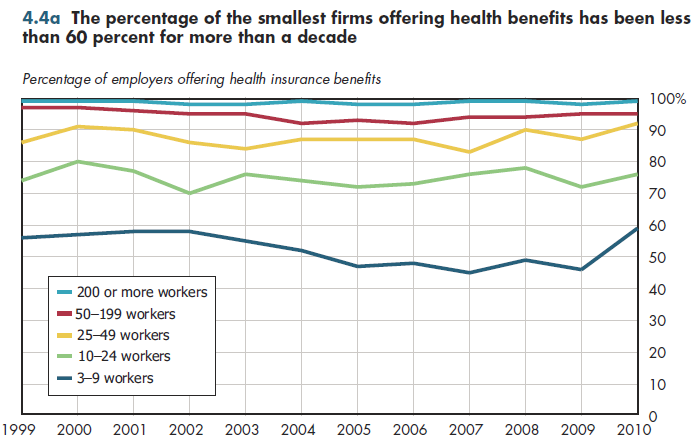

Health insurance offer rates have been remarkably stable over the past decade (figure 4.4a). Ignoring year-to-year variation, the offer rate for firms with fewer than 10 employees has consistently been less than 60 percent. It is not clear whether the recent uptick in offer rates for the smallest firms is an anomaly or a reversal of recent trends.

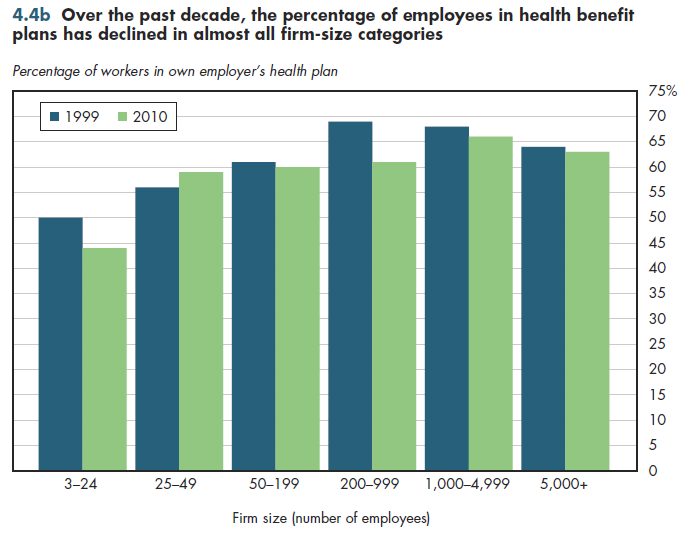

Even though offer rates have been relatively stable over the past decade, the percentage of workers who have employer-based coverage has been eroding rather steadily over the past two decades. Figure 4.4b provides a consistently measured picture of this decline since 1999, and other data confirm similar trends occurring throughout the 1990s. This decline reflects in part trends displayed in figure 4.1a. With health benefit costs rising much faster than wages and salaries, more employees declined offered coverage. Because employers generally contribute a higher share of the premium for an employee's own coverage than for dependent/spouse coverage, this refusal rate tends to be higher for dependent coverage. However, it also can be attributed to a rather steady expansion of public coverage since the mid-1980s — notably Medicaid and the State Children's Health Insurance Plan (SCHIP).

In recent years, this erosion in coverage has been largest among the smallest and mid-sized firms. Because small firms face higher premiums for the equivalent level of coverage, any given percentage increase in medical costs will produce a higher absolute dollar impact relative to larger firms. As well, large firms enjoy the stability that comes with sizable health plan memberships. That is, if medical trends are increasing by 10 percent, the largest firms will tend to experience rate increases in a comparable range. In contrast, small employers may face annual rate increases that are several multiples of the general trend.

In the small-group market, there also is considerably more "churning" as such employers seek a better deal on health insurance coverage. This means that firms that switch face additional costs for broker commissions and underwriting that are avoided by firms opting not to switch. The vast majority of large employers are self- insured, so generally the principal savings that can be attained by switching carriers to administer such plans relate to administrative costs that are not terribly large in the first place. Consequently, the incentive to change carriers is much lower.

Downloads

References

- Kaiser Family Foundation, The. Health Research & Educational Trust. Employer Health Benefits 2010 Annual Survey. September 2, 2010. http://ehbs.kff.org/?page=abstract&id=1 (accessed November 21, 2010).

Collection Navigation

- « Previous module in collection 4.3 Small Firms Least Likely Offer Health Coverage to Employee

- Collection home: American Health Economy Illustrated

- Next module in collection » 5.1 Government Expenditures for Health, 1929-2009

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 12, 2013 9:02 pm -0500