Download PowerPoint versions of both figures.

Inside Collection (Textbook): American Health Economy Illustrated

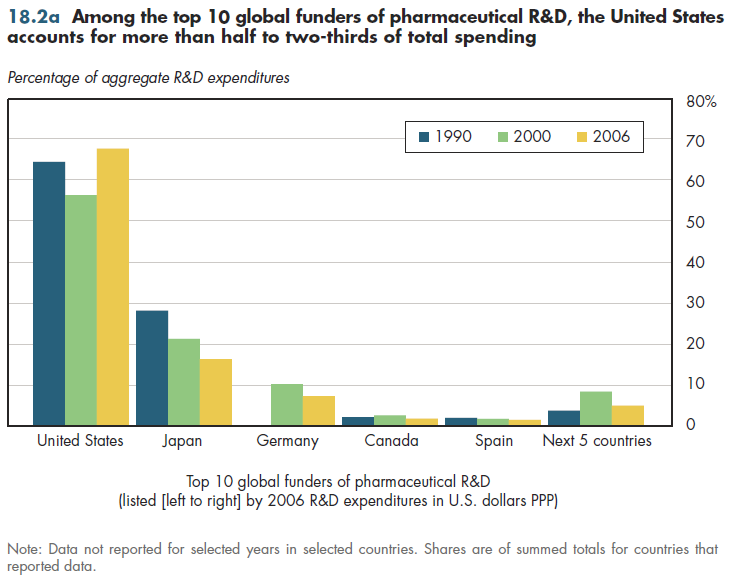

18.2 US Accounts for More than Half of World Pharmaceutical R&D Spending

Summary: Among the top 10 global funders of pharmaceutical R&D, the United States accounts for more than 50 percent to 65 percent of total spending.

The U.S. dominance in pharmaceutical research can be measured in two ways. First, among the 10 countries that rank highest in pharmaceutical R&D expenditures, the U.S. share has ranged from more than 50 percent to 65 percent of the collective R&D spending by this group (figure 18.2a). This has been true since at least 1990. Unfortunately, information is available for only four of these countries for 1980; thus, it is not possible to attain certainty about the U.S. share that long ago.

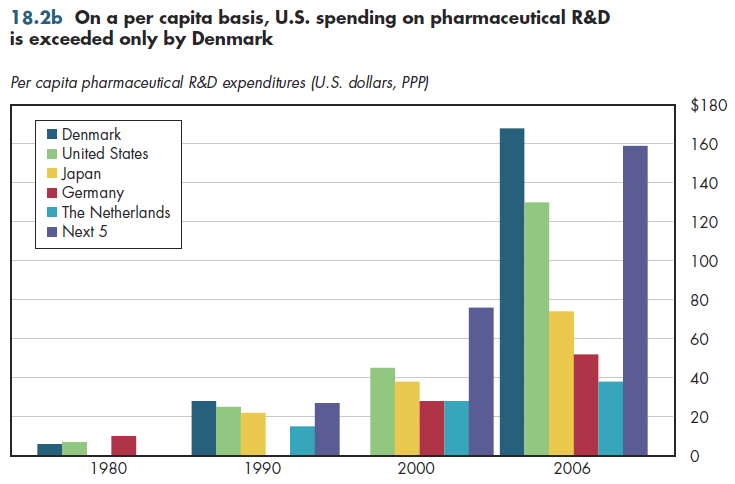

Of course, the United States has a substantially larger population than any of the others on this list. Thus, an arguably better comparison examines pharmaceutical R&D spending per capita (figure 18.2b). Doing so reveals that only Denmark has higher relative spending on pharmaceutical R&D than does the United States; in 2006, Denmark ranked sixth on the top-ten list cited (figure 18.2a).

Some demand-side factors might affect where pharmaceutical companies are located. However, location decisions of major pharmaceutical companies also are driven by the availability and cost of the scientific research personnel required to conduct R&D, and by government regulations that affect how R&D is conducted.

Another factor that has fueled U.S. pharmaceutical R&D relates to generic competition. The Hatch-Waxman Act enacted in 1984, designed to promote the use of generics, and the rise of managed care formularies have been cited as the principal drivers of growth in the U.S. generic drug industry. Unless there are externalities (my taking a drug benefits or harms someone else's health), competition should lead to the desired result of pushing drug prices down to the marginal cost of producing them. It likewise will encourage a socially optimal level of consumption, that is, where the marginal benefit of consumption equals the marginal cost of supplying a drug. Numerous studies have shown that following the expiration of patents, prices fall toward marginal costs (the more generic competitors, the more prices fall). Generic competition thus forces brand-name pharmaceutical manufacturers to invest in R&D to ensure a steady pipeline of new products under development.

Downloads

References

- Organisation for Economic Co-operation and Development.

Collection Navigation

- « Previous module in collection 18.1 US Leads the World in Medical Innovation

- Collection home: American Health Economy Illustrated

- Next module in collection » 18.3 US Accounts for a Relatively Small Share of Pharmaceutical Exports

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 27, 2013 2:03 pm -0500