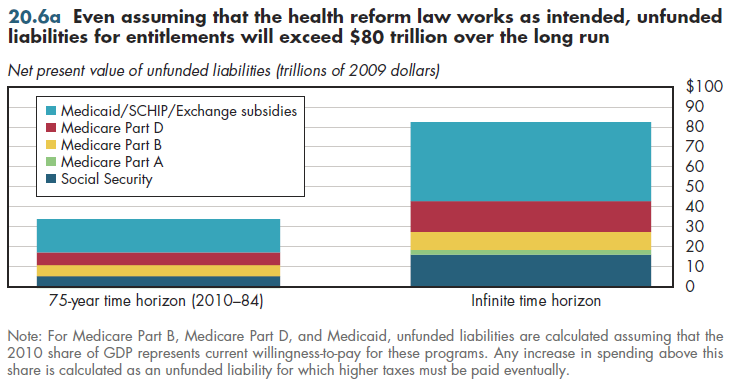

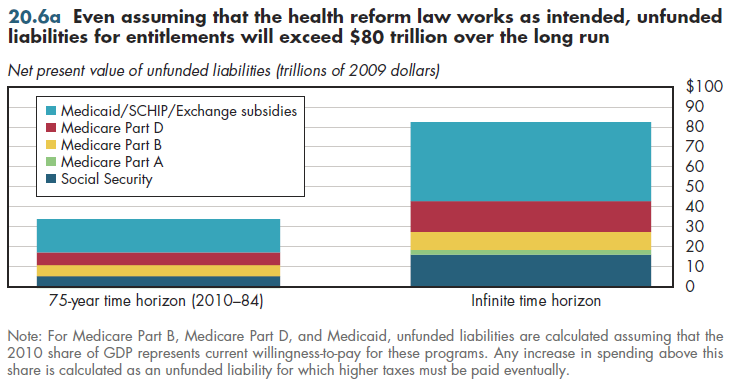

The unfunded liabilities for entitlements exceed $80 billion over the long term (figure 20.6a). Only approximately 20 percent has to do with Social Security. The rest ($66 trillion) is due to health entitlements. If it works as planned, the new health plan will reduce unfunded liabilities for Medicare by tens of billions of dollars.

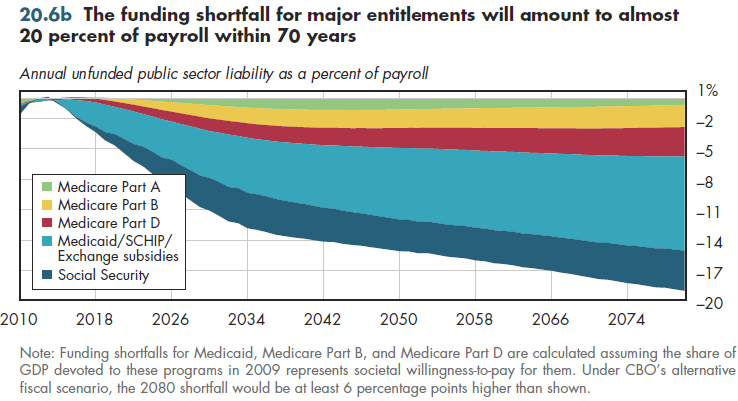

However, both the Medicare actuary and the CBO have raised questions about whether some of the law's underlying premises will be maintained. For example, all the CBO projections used in this section assume that physician fees under Medicare will be cut by approximately 30 percent. With looming physician shortages, few believe such a drastic cut is desirable even though current law technically requires it. As it has for the past eight years, Congress is expected to keep deferring this scheduled cut indefinitely or to change the law to eliminate it. The CBO has developed an alternative fiscal scenario in which this and several other policies designed to limit spending would not continue. Under these alternative assumptions, Medicare spending as a percent of GDP in 2080 (as estimated by the CBO) would be two percentage points higher than illustrated in figure 20.5b.

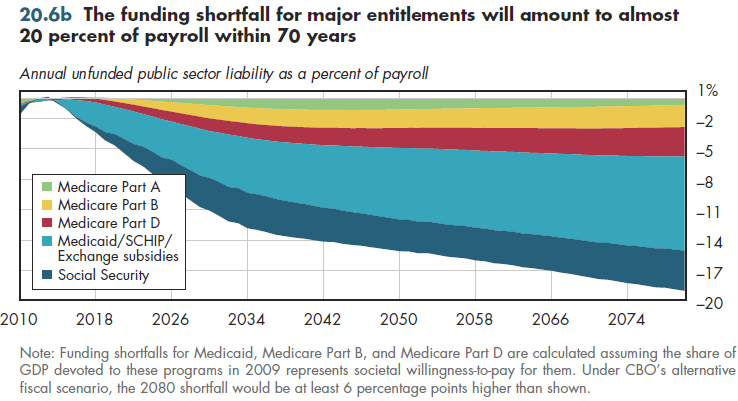

Calculations for unfunded liabilities assume that current payroll tax levels for Social Security and Medicare Part A remain in effect. Another assumption is that the current level of Medicaid and Medicare Parts B and D spending (as a percentage of GDP) reflect societal willingness-to-pay for these programs. The "unfunded" amount equals the increase in the burden (relative to current levels) required to sustain these programs.

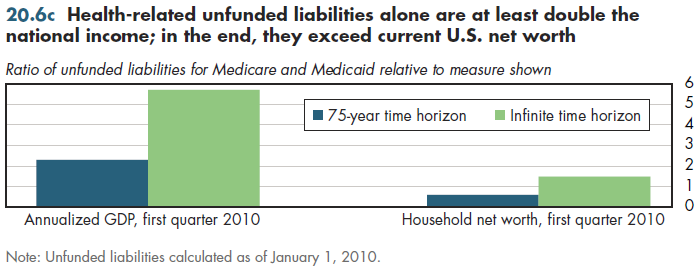

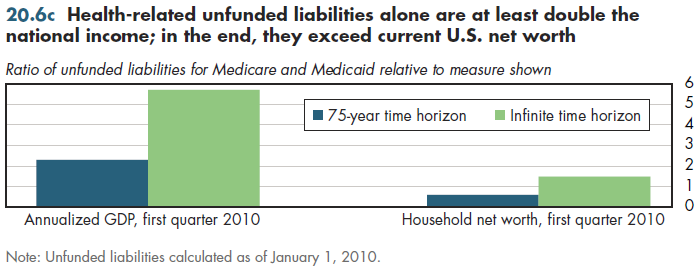

To give some sense of whether these entitlements are "affordable," figure 20.6b expresses the funding shortfall as a percent of payroll. Essentially, the Social Security (FICA) payroll tax of 15.3 percent would have to more than double by the year 2080 simply to bankroll health-related entitlements. In present-value terms, the long-term unfunded liability is five times the U.S. national income (GDP) (figure 20.6c). This is approximately equivalent to assuming a mortgage equal to five times a family income. The unfunded liability is 1.5 times as much as the country's net worth. This is approximately equivalent to borrowing 1.5 times a family's net worth. Countries are not families, but these comparators at least provide a rough sense of just how large the problem of funding future entitlements has become.

Download PowerPoint versions of all figures.

- Author's calculations.

- Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, The. 2010 Annual Report. US Government Printing Office. August 5, 2010.

- Congressional Budget Office.

- Department of Commerce. Bureau of Economic Analysis.

- Social Security Administration.