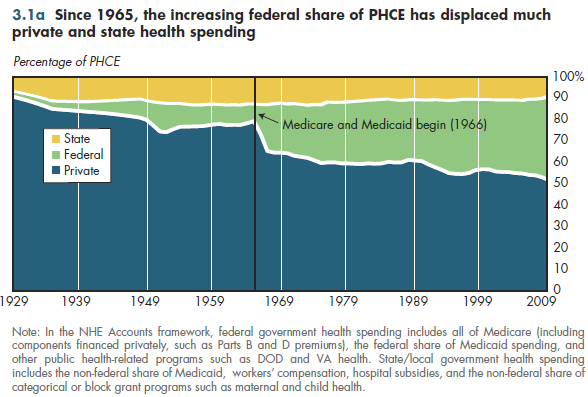

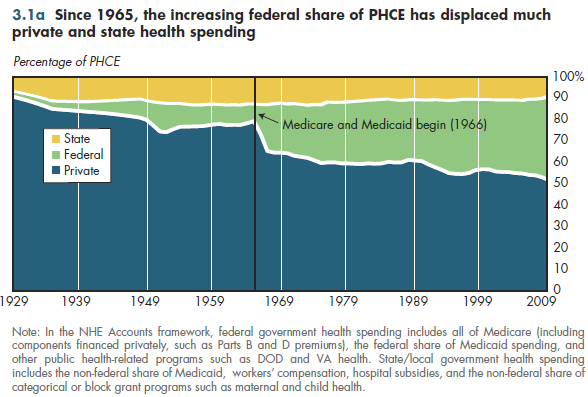

Examining health financing from the standpoint of who literally pays the final bills, a rather steady expansion in the public-sector share of NHE that goes back at least 80 years becomes obvious (figure 3.1a). Starting in the 1960s, when both Medicare and Medicaid first began, the public share of financing increased much more sharply than it had previously.

From this standpoint of government as payer, Medicare is a federal responsibility because all funds flow through the general treasury before distribution to private administrators who pay claims from providers. This includes all the payroll taxes used to support Part A (inpatient hospital and nursing home services), together with the voluntary premiums for Part B (physician and other outpatient services) and Part D (prescription drugs). Medicaid—jointly financed by the federal and state governments —nominally increased state and local responsibility for care. In reality, the greatly expanded federal role in health care financing in 1965 displaced much of the traditional state and local government role in paying for care of the poor, disabled, and elderly. Consequently, the state and local share of health spending declined steadily since the 1960s as the federal share expanded. The federal displacement of private insurance and family out-of-pocket payments in this period was even greater.

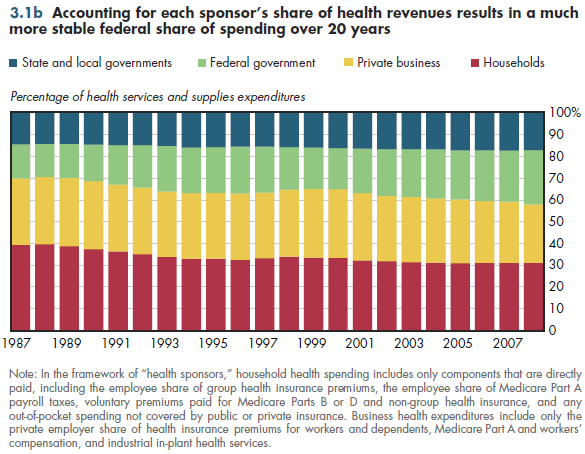

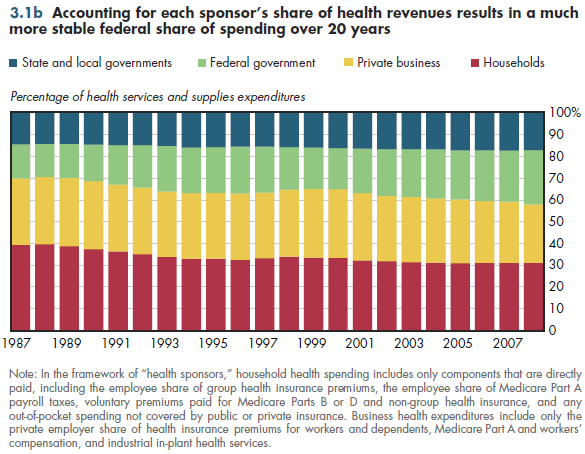

An alternative way to view health spending is in terms of sources of revenue. Even though households ultimately incur the burden of all health spending, it is possible to differentiate revenues flowing from households, businesses, and various levels of government. In this so-called sponsor view, half of Medicare payroll taxes are assumed to be paid by employers and half paid by employees (households) rather than by the federal government. Conversely, the cost of the Federal Employee Health Benefits Plan (FEHBP) is shifted from private insurers (under the payer view) to the federal government (employer contributions) and households of covered members (premiums paid by federal employees/retirees).

From this sponsor view of health financing, the relative shares of spending paid by business, households, the federal government, and state and local governments have been remarkably stable over the past 20 years (figure 3.1b). Nevertheless, the public role in financing has grown slightly over this period.

Download Excel workbooks used to create

Figure 3.1a Tables and

Figure 3.1b Tables.

[Note that you’d have separate links for each set of tables] Figures 3.1a and 3.1b were created from the following tables (the workbook includes all supporting tables used to create this table):

- Fig. 3.1a: Table 3.1.1. U.S. Personal Health Expenditures by Source of Funds: 1929 to 2021

- Fig. 3.1b: Table 3.1.2. Distribution of National Health Expenditures by Sponsor: 1987 to 2011

Download PowerPoint versions of both figures.

- Author's calculations.

- Department of Health and Human Services. Centers for Medicare and Medicaid Services.

- Worthington NL. National Health Expenditures, Calendar Years 1929-73. Research and Statistics Note No 1. Office of Research and Statistics 1975.