Download PowerPoint versions of both figures.

9.5 R&D Has Contributed to Increase in Health Sector Productivity

Summary: Expenditures for R&D have expanded our scientific and technological knowledge; this has contributed to the increase in health sector productivity.

Note: You are viewing an old version of this document. The latest version is available here.

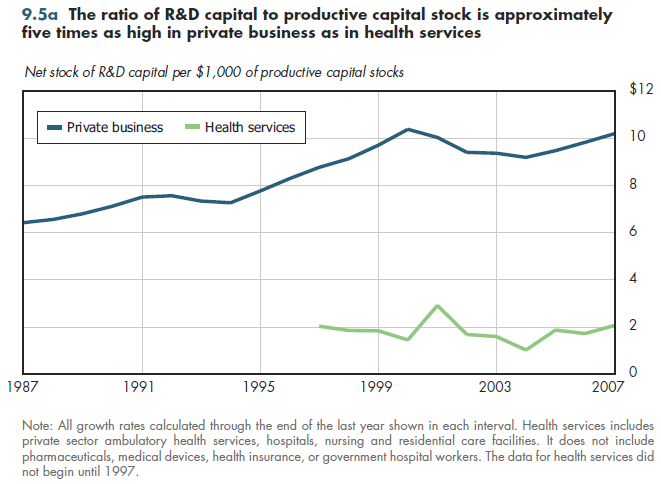

Relative investments in R&D appear to be less in the health sector than in private business overall. By one traditional measure—the ratio of R&D capital to productive capital stock—R&D investments are approximately five times as large in the private sector as in the health services industry (figure 9.5a). Ignoring details of measurement, productive capital stocks simply are a way of measuring the total amount of capital available at any given time, accounting for the fact that all other things being equal, new capital is more productive than old capital.

By some measures, growth in capital stock is higher in some health-related industries than in the general economy. Unless R&D investments also increased at a similarly accelerated rate, the ratio of R&D to capital stocks would tend to decline even if investments in R&D were growing at identical rates in health care compared with the general economy.

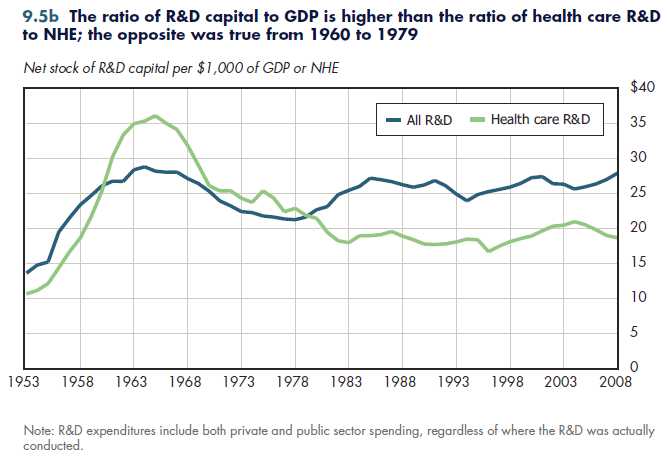

Thus, a more "neutral" comparison would be to measure R&D relative to total output. When done, the health sector looks much more comparable to the general economy (figure 9.5b). There have been periods such as 1960-1979 in which relative R&D investments have been higher in health care. However, using this same measure, the current level of R&D in the overall economy is approximately 50 percent higher than in health care.

Neither of these measures proves that the health sector invests "too little" in R&D. First, they are only approximate measures. Second, the measure that compares R&D to productive stocks is limited to one component of the health industry, leaving out the subsector—pharmaceuticals—that arguably is the most important from an R&D perspective. Finally, whether an investment in R&D makes sense in any industry depends on the technological opportunity set available at that time. The expected rate of return to such investments often can depend on advances in basic science (for example, nanotechnology) that are beyond the control of any given industry. As long as there are differences in such rates of return, disparities in the rate of R&D investment are unavoidable.

Downloads

References

- Author's calculations.

- National Science Foundation.

Content actions

Give feedback:

Add module to:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 27, 2013 1:50 pm -0500