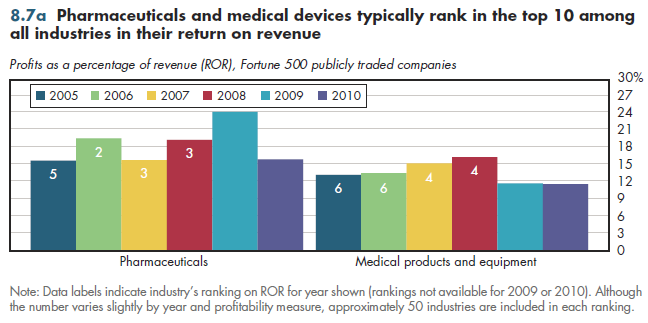

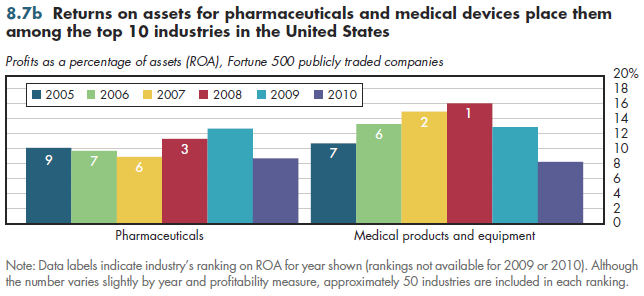

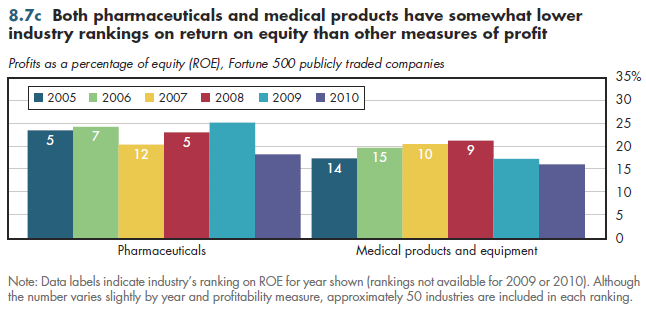

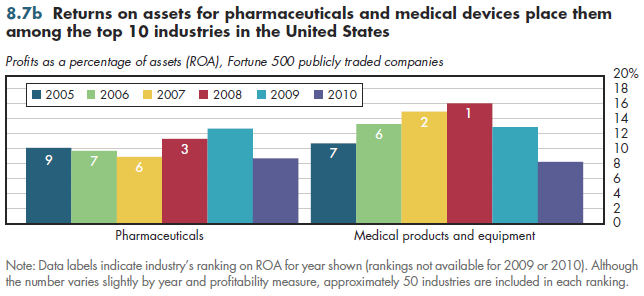

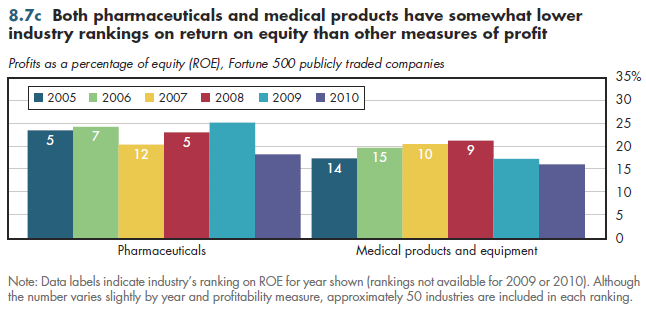

Pharmaceuticals and medical devices typically rank among the top 10 most profitable industries in America. This is true whether profits are measured as a return on revenue (figure 8.7a), return on assets (figure 8.7b), or return on equity (figure 8.7c). Occasionally, one of these two industries ranks first among all industries in some measures of profitability (figure 8.7b).

Several reasons explain why these two health industries are so much more profitable than the various health-related services industries just examined. First, as shown previously, both industries consist entirely of for-profit firms, creating an arguably more competitive environment. Although there are mixed findings regarding performance of for-profit versus non-profit or government-owned enterprises, almost all comparisons agree that rates of return (however measured) are higher in for-profit firms relative to the not-for-profit counterparts.

Second, patents play a far more important role in pharmaceuticals and medical devices than in the rest of the health care sector. By design, patents are structured to encourage innovation by permitting their owners to earn monopoly returns for a limited time. Although the nominal patent term is 20 years, more than half of this time is typically lost before Food and Drug Administration (FDA) approval due to the lengthy time required for clinical trials and regulatory review.

Third (and related), pharmaceutical R&D especially is a complex, costly, risky, and time-consuming process. Including the costs associated with hundreds of compounds that do not succeed, as well as the cost of capital (financial resources) that is unavailable for other uses during this lengthy process, more than $1 billion is spent to bring a single new drug to market. Absent the incentives provided by the patent system, there is no question that the amount of pharmaceutical R&D would be considerably less. Concomitantly, the number of new drugs discovered would be fewer. Thus, high profits represent the price paid for the benefits of new discoveries.

Whether profits are higher than needed to bring forth an optimal level of innovation is a perennial question. Several different analyses have concluded that the high level of pharmaceutical profits only slightly exceeds the industry's cost of capital. Briefly, investors demand higher profits to invest in an industry where returns on R&D are so risky.

No tables for figures since source is reported on each sheet.

Download PowerPoint versions of both figures.

- Fortune 500. Our Annual Ranking of America's Largest Corporations. http://money.cnn.com/magazines/fortune/fortune500/2009/performers/industries/ profits/index.html (accessed June 9, 2010).