Download PowerPoint versions of figure.

Inside Collection (Textbook): Chapter 12: Distribution of Health Services

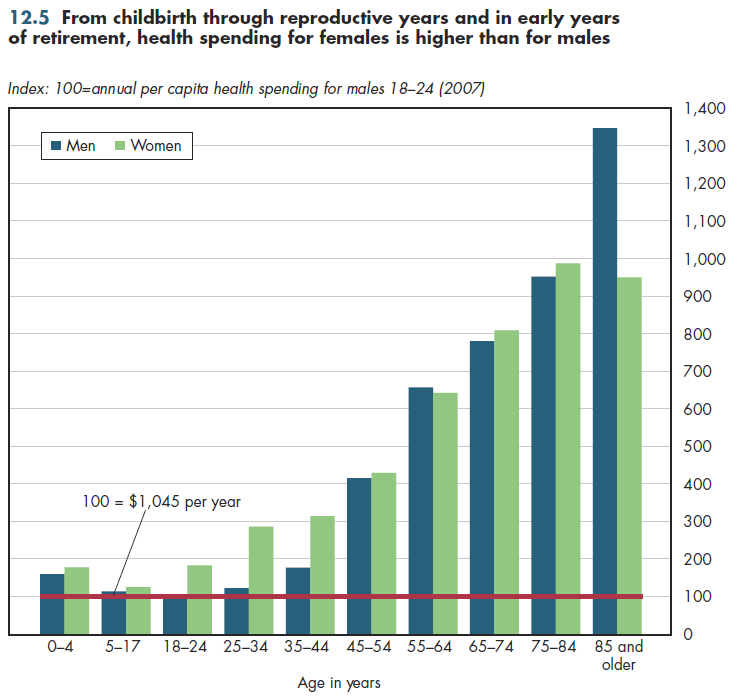

12.5 Difference between Men and Women's Health Costs Depends on Age

Summary: During their reproductive years, women's health costs are much higher than are men's and only slightly higher in early retirement.

When spending by gender is separated, the rise in spending with age no longer is inexorable. In reproductive years, women's health expenditures are approximately twice as large as that for men (figure 12.5). In 2007, the average childbirth cost $8,800. Because the average fertility rate is 2.1 births per female age 15-44, this alone would add more than $500 a year to annual spending by females. Figure 12.5 is indexed to health spending for males age 18-24 rather than in raw dollars. This difference between men and women during childbearing years is approximately $1,000; thus, childbirth accounts for much but not all of the difference.

Female health spending also is slightly more in the early years of retirement, but for the "oldest old," there is a dramatic shift. Men's health spending soars to more than 15 times the level of their 18 to 24-year-old counterparts, but women's spending actually declines. Recall that these data exclude the institutionalized population. Because women have a higher rate of nursing home use compared with men at all ages 65 and older, inclusion of nursing home costs likely would yield a different result. With 16 percent of oldest-old women in nursing homes and average nursing home costs of approximately $75,000 a year, this alone would add more than $10,000 to their per capita spending but only half that amount to men's.

Much of the male-female difference in spending at age 85 and older relates to the high cost of dying. Decedents cost approximately 50 percent more than do survivors of the same age and diagnosis. However, they cost several multiples of the spending made by the average survivor at any given age (decedents are more likely to be sick). Because female life expectancy at age 85 is more than 20 percent higher than that of men's, a higher share of remaining lifetime health costs for males will consist of decedent spending.

End-of-life costs account for approximately 10-12 percent of all health spending. The exact fraction that is publicly financed is unknown. Approximately 80 percent of decedents qualify for Medicare, of whom 20 percent also qualify for Medicaid. Assuming that 100 percent of costs for "dual eligibles" and only half of costs for Medicare eligibles are covered by public insurance, this would imply that taxpayers fund approximately half of end-of-life care. The true number likely is higher.

Downloads

References

- Department of Health and Human Services. Centers for Medicare and Medicaid Services.

Collection Navigation

- « Previous module in collection 12.4 Per Capita Health Spending Increases with Age

- Collection home: Chapter 12: Distribution of Health Services

- Next module in collection » 12.6 Regional Differences in Health Spending per Capita Have Narrowed then Widened

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 26, 2013 1:49 pm -0500