Download PowerPoint versions of both figures.

13.5 Medicaid Covers Less than 1/3 of Poor Non-Elderly Adults

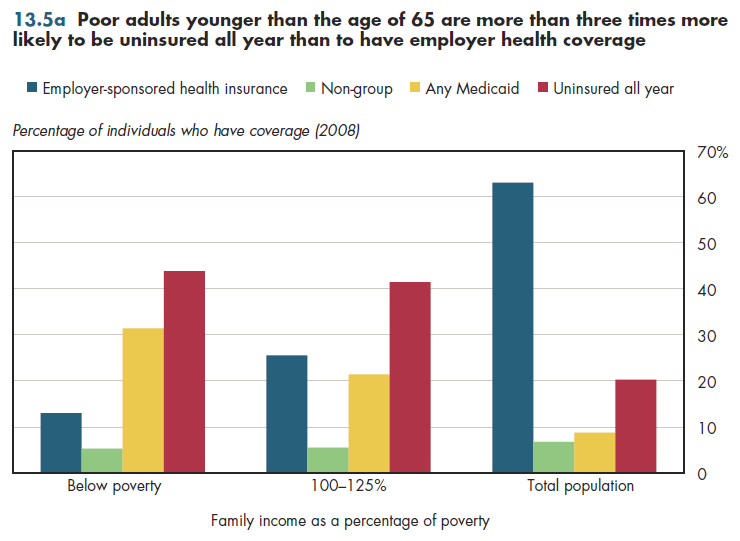

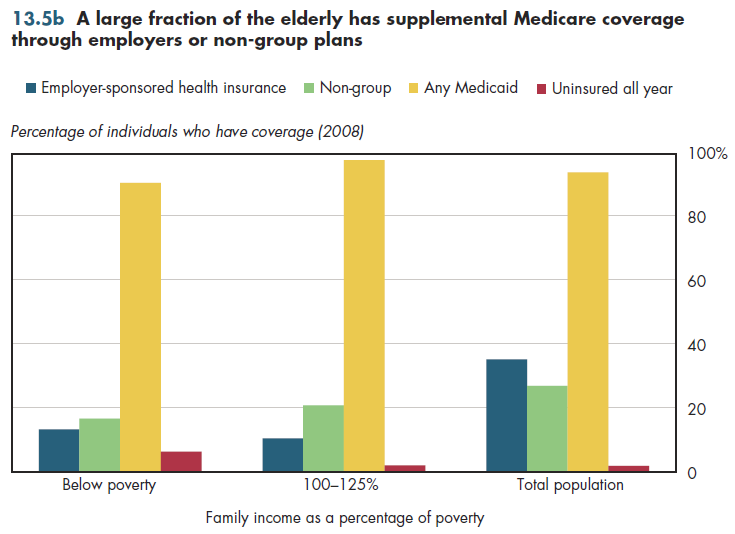

Summary: Fewer than one-third of non-elderly adults who are poor are covered through Medicaid. More than 40 percent are uninsured. Although more than 90 percent of the elderly poor have government coverage, approximately three in 10 have some sort of private insurance.

Twenty percent of poor adults younger than age 65 have private health insurance coverage (figure 13.5a). Among those who have incomes from 100-125 percent of poverty, this amount is approximately 30 percent. Yet slightly more than 40 percent of both groups were uninsured. Approximately one in 20 individuals in both low-income groups had non-group coverage; thus, this cannot explain the difference. This percentage was not much different from the share of the total adult population younger than age 65 having non-group coverage.

Differences in government coverage explain why the uninsured rate for the poor is almost equal to that of the non-poor despite lower rates of private coverage. Approximately 30 percent of poor adults have some sort of public coverage, most of which is through Medicaid. For the near poor (up to 125 percent of poverty), only one in four have government coverage. As with children, Medicaid accounts for most of this public coverage.

Private coverage among the elderly (age 65 or older) below poverty is approximately 50 percent higher than it is for children or non-elderly adults (figure 13.5b). One in 20 elderly adults below poverty is uninsured because Medicare is available only to those who have a qualified wage history or those able and willing to pay premiums for their coverage.

Approximately 25 percent of poor persons who are elderly are "dual eligible" for Medicare and Medicaid. Approximately 20 percent of these live in nursing homes or other long-term-care facilities. Consequently, approximately 45 percent of spending for this group is for long-term care. Medicare covers acute care services, with Medicaid covering any beneficiary premium payments (for Parts B or D) and cost-sharing obligations (deductibles and coinsurance). All told, Medicare finances approximately 65 percent of acute care spending for "dual eligibles."

In contrast, Medicare does not pay for long-term care. It pays for only sub-acute care, that is, time-limited home health or nursing care services needed for rehabilitation following a hospital stay. As a result, Medicaid finances $5 of every $6 in long-term care and sub-acute care services.

Downloads

References

- Department of Commerce. Bureau of the Census.

Content actions

Give feedback:

Add module to:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 26, 2013 1:41 pm -0500