Download PowerPoint versions of figure.

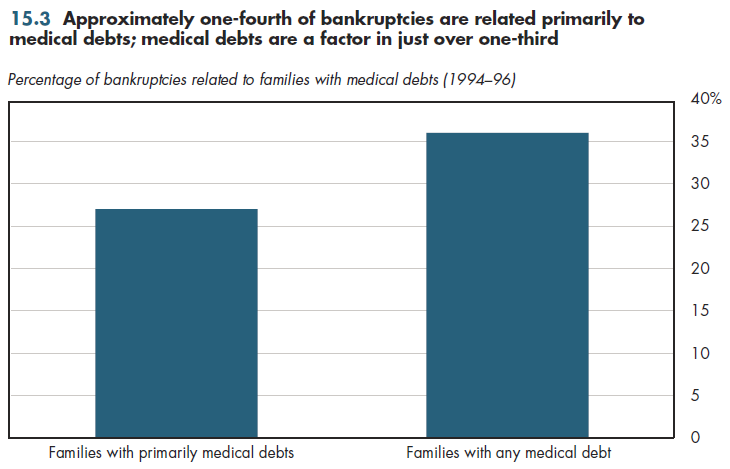

15.3 "Medical" Bankruptcies Account for 25-35% of US Bankruptcies

Summary: "Medical" bankruptcies account for 25 percent to possibly 35 percent of all bankruptcies in the United states.

Families whose principal reason for debt relates to medical bills account for approximately 25 percent of all bankruptcies. Other experts have suggested that this number might be much more than this, but this assumption uses an overly broad definition of a medical bankruptcy. The numbers shown in figure 15.3 represent evidence from the first study that separates the problem of paying medical bills from other problems that bankruptcy filers face, including loss of employment, low income, or other sources of debt, particularly credit card debt. According to this study, even if medical bankruptcy were defined to include all families having any medical debt, such families would account for just over 35 percent of bankruptcies.

Poor health can result in loss of income or even loss of a job—an impact that can greatly exceed the effects of medical bills. Thus, even for families whose debt primarily relates to medical bills, there is no guarantee that bankruptcy could have been avoided had their medical bills been eradicated, that is, paid by someone else. The average amounts of the medical bills involved in bankruptcy cases are surprisingly small. One study by the U.S. Department of Justice (DOJ) found that only 11 percent of bankruptcy filers had medical bills in excess of $5,000. Medical debt accounted for 50 percent or more of total unsecured debt in only one of 20 cases. Across all filers, medical debt averaged only approximately 6 percent of all unsecured debt.

The limited available evidence suggests that fluctuations in the cost of health care are not linked to increases or decreases in bankruptcy rates. There has been a secular increase in bankruptcy filings entirely independent of increases in medical expenditures. There is more mixed evidence about whether bankruptcy rates have been affected by trends in insurance coverage. Approximately 60 percent of bankruptcies are filed by families who have health insurance. Thus, if the new health reform law results in expanded coverage, in principle this will reduce bankruptcy risk. The new law eliminates ceilings on lifetime coverage and places maximum limits on out-of-pocket spending. This too will lower bankruptcy risk, but for all the reasons reviewed, it seems unlikely that bankruptcies would decline by 25 percent.

Downloads

References

- Mathur A. Medical Bills and Bankruptcy Filings. American Enterprise Institute. http://www.aei.org/docLib/20060719_MedicalBillsAndBankruptcy.pdf (accessed July 28, 2010).

Content actions

Give feedback:

Add module to:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 25, 2013 2:21 pm -0500