Download PowerPoint versions of figure.

Inside Collection (Textbook): Chapter 15: Health, Wealth, and Debt

15.2 Low-Income US Family May Incur Health Spending that Exceeds Their Net Worth

Summary: A relatively small fraction of American households incurs annual health expenditures that exceed their net worth.

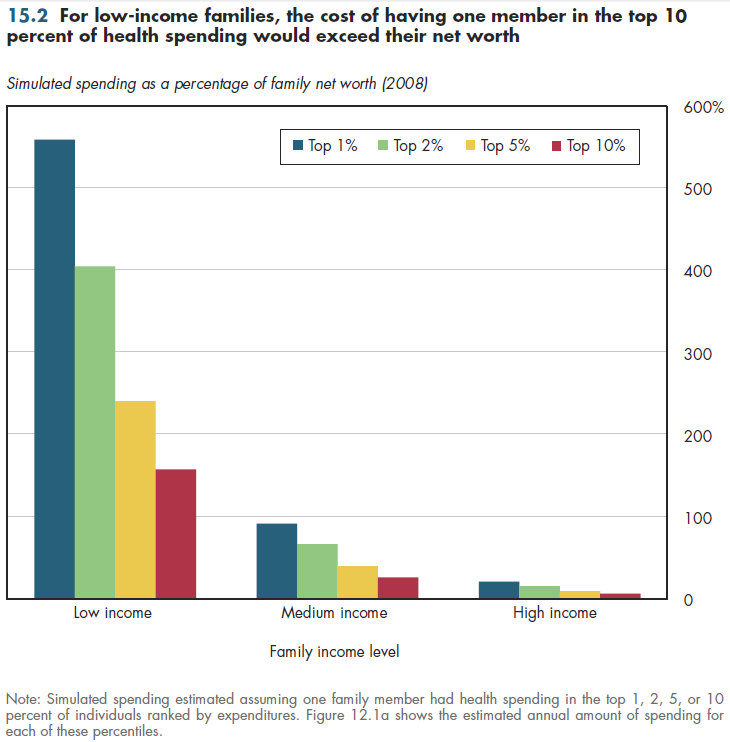

For low-income families, the cost of having one member in the top 10 percent of health spending would exceed their net worth. Thus, low-income households are more vulnerable to bankruptcy risk from medical expenses. The question is how large a risk they face.

Our conventional sources of health spending at the household level do not provide information on household wealth. Therefore, as an approximation, available information on the distribution of net worth across households was compared with the average per capita spending amounts for individuals in particular parts of the spending distribution (refer to figure 12.1a). This gives an approximate sense of the vulnerability to bankruptcy risk, but it is not equivalent to determining that a specified fraction of low-income families actually undergoes a bankruptcy caused by medical bills.

As an example, a low-income household having just one member whose medical spending fell into the top 1 percent of spending, would, on average, incur medical bills more than five times their net worth (figure 15.2). This is no guarantee of bankruptcy because if they are Medicaid-eligible, their third-party coverage finances all or almost all of such bills. Likewise, if such a family had private medical insurance, much of this hypothetical burden would be shifted onto others. Even if such a family were entirely uninsured, the safety net absorbs a considerable fraction of health expenditures (refer to figure 3.9b).

For a middle-income family, having one member in the top 1 percent would result in bills almost equal to the family's net worth. Again, whether this circumstance would actually force the family to declare bankruptcy would depend on the particular situation. A large public or teaching hospital might be in a better position to write off an expensive stay than would a small community hospital with low or negative operating margins. In contrast, for the highest income families, paying the bill theoretically ought to be relatively easy even if they lacked insurance and were responsible for the entire bill. It would wipe out 20 percent of their net worth, but presumably, this would not trigger bankruptcy.

Downloads

References

- Author's calculations.

- Department of Health and Human Services. Centers for Medicare and Medicaid Services.

- Federal Reserve Bank.

Collection Navigation

- « Previous module in collection 15.1 Health Spending per Capita Has Grown Twice as Fast as per Capita Net Worth

- Collection home: Chapter 15: Health, Wealth, and Debt

- Next module in collection » 15.3 "Medical" Bankruptcies Account for 25-35% of US Bankruptcies

Content actions

Give feedback:

Download:

Add:

Reuse / Edit:

Twin Cities Campus:

- © 2012 Regents of the University of Minnesota. All rights reserved.

- The University of Minnesota is an equal opportunity educator and employer. Privacy

- Last modified on Sep 25, 2013 2:20 pm -0500